Description

Transaction Type: Equity Investment

Equity Offered: 30%

Capital Requested: SGD 500,000

Use of Funds: Team expansion, AI infrastructure scaling & regulatory licensing in Singapore

Company Type: Singapore-based proprietary quantitative trading firm

Sector: Quantitative Trading | AI | US Equities | Crypto | Futures

🏢 Company Overview

We are a Singapore-registered proprietary quantitative trading firm specializing in U.S. equities, with expanding operations in cryptocurrency arbitrage, U.S. futures, and multi-asset systematic strategies.

Key Stats

- 30+ proprietary trading algorithms

- AUM: USD $3M

- Daily turnover: 20%

7 core team members (C++ low-latency engineers, AI researchers, quant traders)

Full in-house AI research and trading engine

Proprietary C++ backtesting system + exchange connectors (NYSE/Nasdaq/Cboe)

Automated multi-asset trading system (US equities, crypto, stablecoin arbitrage)

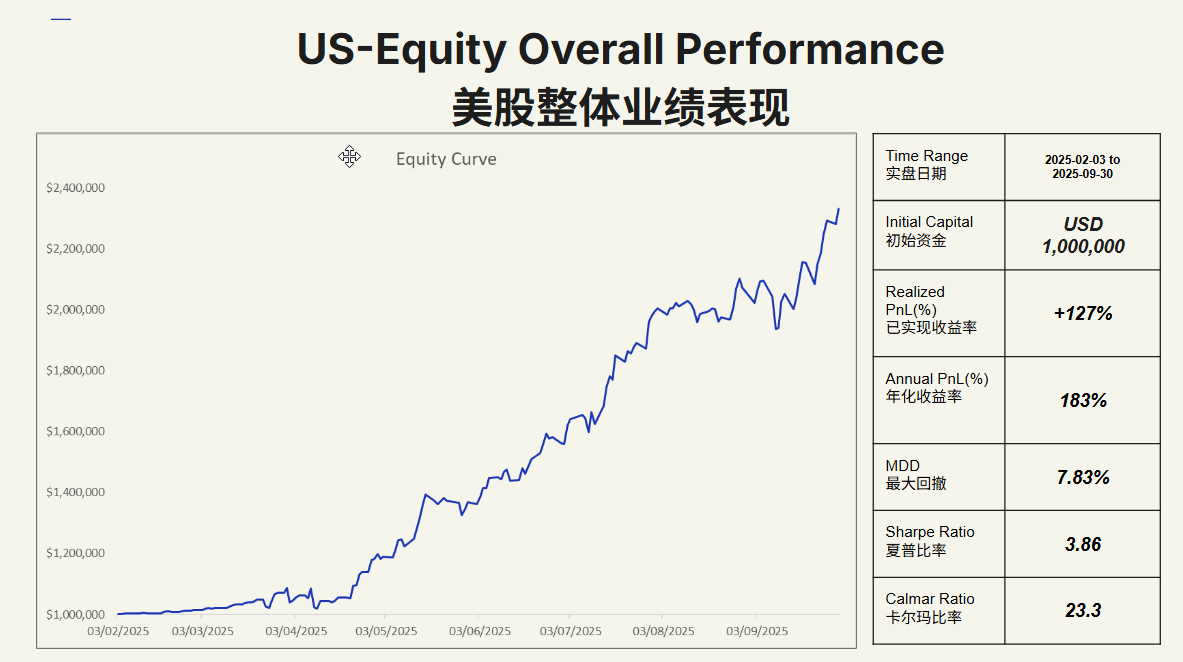

📈 Real Performance (Live Trading)

US Equities Portfolio (Feb 2025 – Sep 2025)

+127% realized return

Sharpe Ratio: 3.86

Max Drawdown: 7.83%

Annualized Return: 183%

Calmar Ratio: 23.3

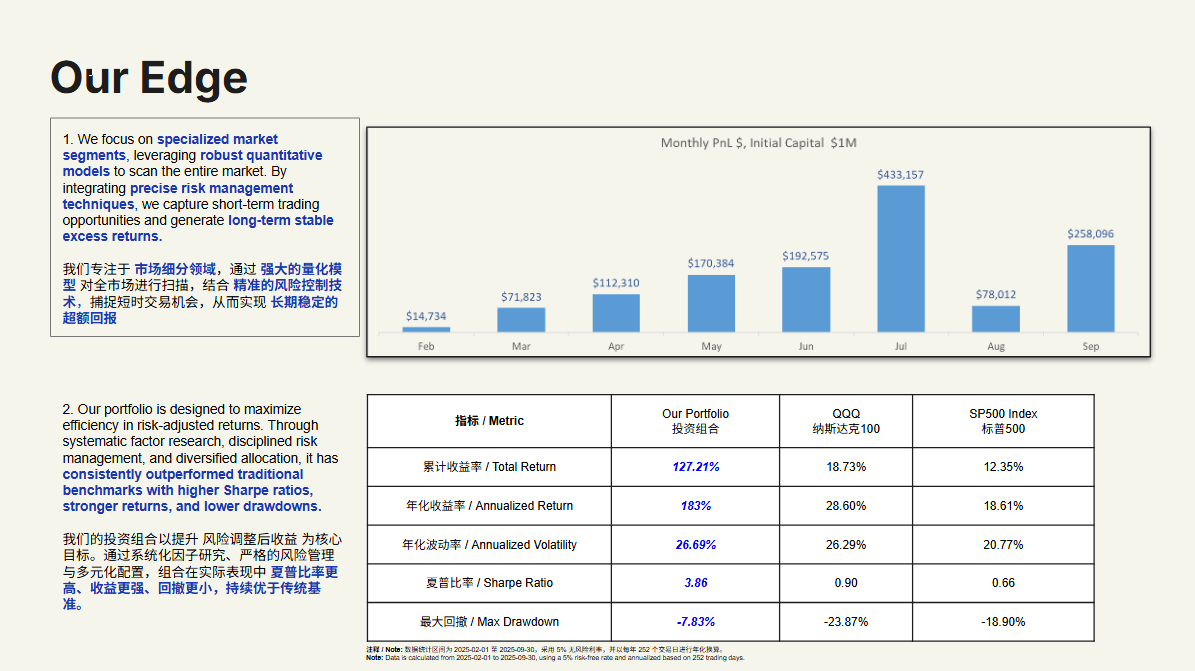

🧠 Technology & Competitive Edge

1. End-to-End AI Strategy Engine

Generates and validates new factors & strategies automatically

Already produced 30+ validated strategies across market regimes

High throughput research pipeline with multi-agent AI

2. Full Automated Trading Infrastructure

In-house C++ low-latency engine

Custom market data pipelines

Exchange connectivity across NYSE/Nasdaq/Cboe/MiAX

Ultra-fast backtesting + live execution sync

Supports US equities, crypto, futures, stablecoins

3. Extremely Lean Cost Structure

37–42K SGD monthly burn

Covers 7 full-time staff, 2 interns, office & infra

Automation allows scaling without large headcount

High operational efficiency + low error rates

💼 Team

Myself – Founder & Head of U.S. Equities

5+ years US equities trading, two successful startup exits, leads performance & operations.

Head of Automated Trading Systems

20+ years C++ ultra-low-latency; built infra for Binance/OKX/FTX; SGX colo outperforming benchmarks by 200µs.

Head of Backtesting Systems

18 years C++ & networking (ex-Binance/Flextrade), built gateways, market data pipelines, AWS trading infra.

Chief AI Engineer

Ex-Tencent ML Engineer, contributed to Tencent Hunyuan LLM; leads AI agent system & factor engine.

Crypto Quant Lead

NUS MSc; stablecoin arbitrage specialist; >200× turnover, <0.3% MDD strategies.

💰 Valuation

Tangible Assets

Trading infra & equipment: $150K

Cash & equivalents: $200K

Total Tangible: $350K

🚀 Growth Roadmap

3 Years:

AUM: $10M

Full AI-automated multi-asset research pipeline

Expanded crypto/futures lines

Team grows to 10 full-time professionals

5 Years:

AUM: $25M

AI-first mid-sized hedge fund

External investor mandates + proprietary capital

Coverage across US equities, commodities, crypto, and options

📌 Investment Rationale

Investors get:

✔ A stake in a profitable, scalable trading business

✔ Exposure to AI-driven alpha generation

✔ Proprietary technology & infrastructure with high replacement cost

✔ Strong moat in premarket/small-cap US equities & stablecoin arb

✔ Team with tier-1 engineering and trading backgrounds

✔ Early participation ahead of MAS licensing & fund launch