Listing Id: 28943

Last Refreshed: 21/07/2023

Total Views: 6134

(Expired)<-- Investors --> Grow Your Wealth Passively & Increase Your Net Worth

Central AreaBusiness Real Estate For SaleImport and Export Advertising and Marketing Agencies

Asking Price: Price On Request

Business For Takeover

Look For Investor

Look For Partner

- Overview

- Reason For Sale

- Description

Overview

-

Premise Type

Commercial Street

-

Premise Size

N/A

-

Monthly Rental

N/A

-

Rental Desposit

N/A

-

Revenue

N/A

-

Liability

N/A

-

Gross Profit

N/A

-

Net Profit

N/A

-

Stock

N/A

-

FFE

N/A

-

Payable

N/A

-

Receivable

N/A

-

Owner Role

Investor

-

Staff

N/A

-

Established

N/A

-

Source

Direct Seller

Reason For Sale

Sourcing For Investors

Description

Dear Investors,

Are you looking to increase your wealth and net worth?

Do you want to enjoy financial freedom?

Are you on the lookout for another income stream?

Don’t you want to hedge your money against inflation?

By now, it’s common knowledge that real estate investment has long been a favoured asset class for portfolio diversification. And on top of that, real estate is generally known to reap positive returns in the long run.

(For Extra Reading)

https://t.ly/lZm1G

Expat Choice Article (14 Apr 23) - “Property Investment in Singapore A Good Choice”

But even though Singapore is a small country, which areas and districts in this small city-state will bring you the highest rates of return? And which are suitable for you in terms of your investment threshold?

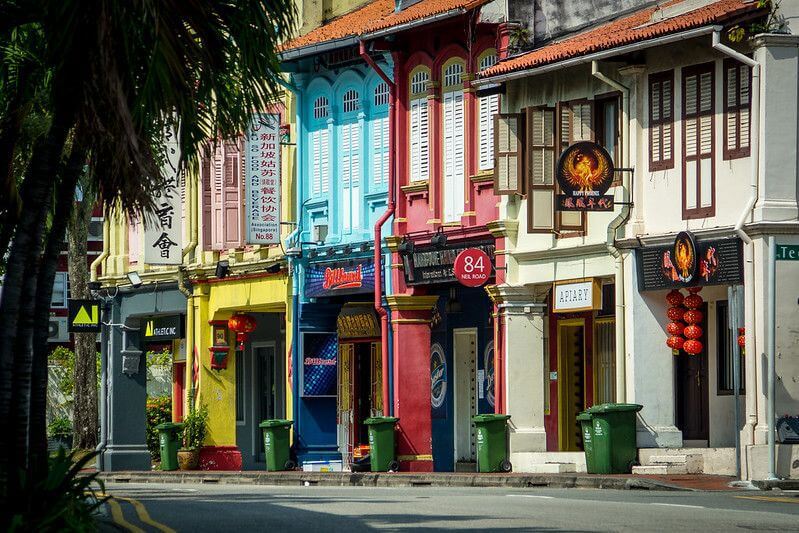

Core Central Region (CCR) areas like Orchard Road? Marina Bay? Bukit Timah? Raffles Place?

Rest of Central Region (RCR) areas like Clarke Quay, Chinatown, Marine Parade, Harbourfront?

Outside of Central Region (OCR) areas like Clementi, Seng Kang, Punggol, Jurong East?

INVEST WISELY IN REAL ESTATE BECAUSE:

Property is a tangible asset

You will enjoy capital gains

Property allows you to build equity

You will enjoy passive income

“Landlords grow rich in their sleep without working or risking.” - John Stuart Mill

WHY BUY REAL ESTATE IN SINGAPORE?

Land Scarcity

Inelasticity of Demand

Stability of Government

Positive outlook of Singapore’s economy

No tax on capital gains

High rental demand

The rise of family offices in the last two years is also pushing up demand in the high-end rental market.

Read:

https://www.businesstimes.com.sg/international/global/singapore-home-more-half-asias-family-offices-report

https://www.channelnewsasia.com/singapore/additional-buyers-stamp-duty-foreigners-rent-buy-singapore-properties-investment-3451681

https://www.channelnewsasia.com/singapore/landed-homes-property-rents-rise-demand-luxury-3527311

You could diversify your investment portfolio, or contemplate asset progression with residential properties:

New launch project

Private apartments

Resale condominiums

Landed housing (semi-detached/bungalows)

These may come with an Additional Buyer’s Stamp Duty (ABSD), but the pros outweigh the cons in the long run.

If you’d rather not fork out the extra cash outlay for the ABSD, you can also opt to purchase commercial properties:

A well-patronised coffeeshop

Retail shop units with high footfall

Quaint colonial shophouse

High-floor office with a scenic view of the waterfront

The right commercial property will always be in demand and attract the corresponding rental yield.

(For Extra Reading)

https://www.scmp.com/business/article/3220217/commercial-property-hong-kong-singapore-only-bright-spots-rising-interest-rates-kill-deals-across

https://sbr.com.sg/commercial-property/news/sgs-commercial-real-estate-sales-jump-40-yoy-us37b-in-q1

https://www.bloomberg.com/news/articles/2023-06-26/singapore-s-skyscrapers-defy-global-commercial-downturn

Whatever your choice may be, let me share with you my experience and expertise, and help you shortlist the most suitable residential/commercial properties that will help you maximise your investment and let your money work for you.

It’s important to invest in the right property, but it’s even more important to do so only when you’re financially ready.

“Don’t wait to buy real estate, buy real estate and wait.” - Will Rogers

Get in touch with us, and allow us to offer you various choices (regularly updated) for your real estate investment portfolio today.

Charles

98370883

https://wa.link/u9jka7